Public Limited Company Registration

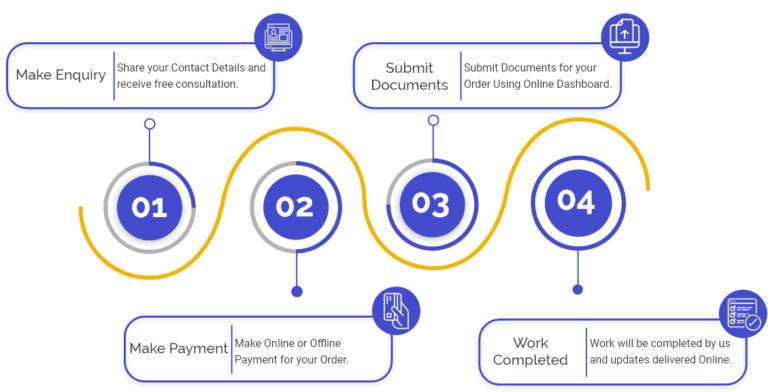

- Assistance with company name reservation and registration

- Guidance on corporate governance and compliance obligations

- Support in obtaining necessary licenses and permits

BookMy

Table of Content

- Public Limited Company Registration - Overview

- What is a Public Limited Company in India?

- Types of Public Limited Companies

- Requirements for Registration of a Public Limited Company

- Advantages of Public Limited Company

- Documents Required for Public Limited Company Registration

How to Start a Public Limited Company Registration

Public Limited Company Registration - Overview

What is a Public Limited Company in India?

Types of Public Limited Companies

The Listed Public Companies are those that have listed their Securities through IPO (Initial Public Offering) or FPO (Follow on Public Offering). For Initial Listing, the Company shall go for launching an IPO*. The Public limited company’s shareholders can actively trade their shares on one or more stock exchanges. This accessibility allows the public and various financial entities to buy and sell the company’s shares, providing greater liquidity and exposure to a diverse pool of investors.

Requirements for Registration of a Public Limited Company

Documents Required for Public Limited Company Registration

- Identity Proof for Shareholders and Directors: Acceptable forms of identification include Aadhar cards, PAN cards, or voter IDs for all shareholders and directors.

- Address Proof for Shareholders and Directors: Documents proving residence are required for all members involved like updated bank statements with address.

- PAN Card Details: These are needed for all directors, shareholders, and members of the company.

- Company Office Address Proof: This can be a recent utility bill (not older than two months) that confirms the location of your company's office or business premises.

- Landlord's Consent Letter: A letter from the landlord of your business premises giving permission for your company to operate from that location.

- Digital Signature Certificates (DSC): These are Required for all designated directors to authenticate documents digitally.

BookmyCompliance.com offers a cost-effective service to facilitate the Private Limited Company Registration process, managing legal formalities and ensuring adherence to MCA regulations. Upon successful registration, you receive a Certificate of Incorporation, along with PAN and TAN documents, enabling you to smoothly initiate business operations after setting up a current bank account

FAQs on Public Limited Company Registration

A Public Limited Company is a type of company whose shares are available for purchase by the public and are listed on a stock exchange. It is subject to more regulation and legal requirements than a private company.

The key difference is that a PLC can offer shares to the public through the stock market, whereas a private limited company cannot. PLCs also have stricter regulatory requirements, such as publishing financial statements and holding annual general meetings (AGMs).

Some basic requirements include:

• Minimum number of shareholders (usually two).

• A certain level of share capital (varies by country).

• Registration with the relevant government authority (such as the Securities and Exchange Commission).

• Appointing directors and fulfilling other governance requirements.

Shares in a PLC can be purchased through the stock exchange, usually through a broker or trading platform. You can also buy shares via Initial Public Offerings (IPOs) when the company is first listed.

Shareholders own the company in proportion to the number of shares they hold. They vote on significant matters during AGMs, such as electing directors or approving major company decisions.

• Ability to raise capital from the public.

• Limited liability for shareholders.

• Enhanced public profile and reputation.

• Greater opportunities for expansion and growth.

• Share transferability.

Yes, a PLC can be taken private if enough shares are bought back or purchased by a small group of investors. This process is known as "going private."

A PLC must have a board of directors, hold regular AGMs, and comply with financial reporting and auditing regulations. Additionally, it must disclose information about its operations, financial status, and major transactions.

A Public Limited Company is a type of company whose shares are available for purchase by the public and are listed on a stock exchange. It is subject to more regulation and legal requirements than a private company.

The key difference is that a PLC can offer shares to the public through the stock market, whereas a private limited company cannot. PLCs also have stricter regulatory requirements, such as publishing financial statements and holding annual general meetings (AGMs).

Some basic requirements include:

• Minimum number of shareholders (usually two).

• A certain level of share capital (varies by country).

• Registration with the relevant government authority (such as the Securities and Exchange Commission).

• Appointing directors and fulfilling other governance requirements.

• High costs and complexity in regulation and compliance.

• Vulnerability to market fluctuations, which can affect the share price.

• Loss of control due to the wide distribution of shares.

• Potential for hostile takeovers if too many shares are bought by outsiders.

PLCs are usually subject to corporate tax on their profits. In some cases, they may be eligible for certain tax benefits depending on their country of operation.

"Shares" refer to individual units of ownership in a company, while "stock" generally refers to the total shares available in the company. Both terms are often used interchangeably, but "stock" can sometimes refer to a collection of shares.

An IPO is the process by which a private company offers its shares to the public for the first time, allowing it to become a PLC. This is typically done to raise capital for expansion or to pay off debt.