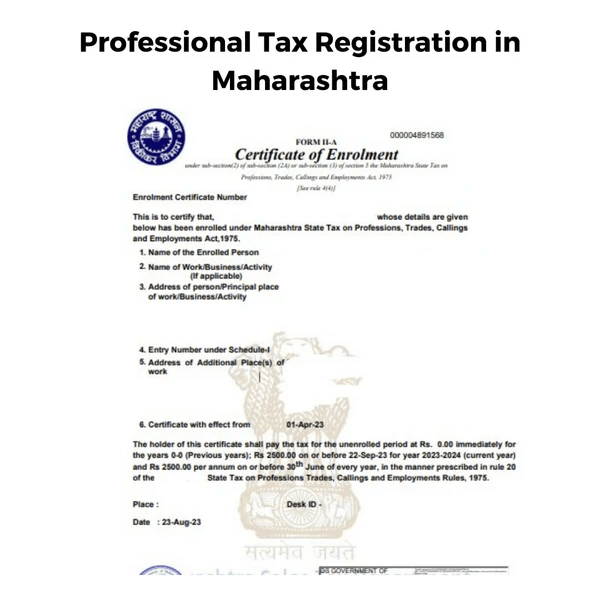

Profession Tax Registration

- Expert-guided online professional tax registration(PTEC & PTRC) in India

- Get your tax registration fast! Guaranteed application filing within 48 hours and certificate in 5 business days

Book My

Table of Content

- Profession Tax Registration – Overview

- Professional Tax Applicability

- Professional Tax Applicable States across India

- States Without Professional Tax

- Professional Tax Rate

- Who Pays Professional Tax (PT)?

Profession Tax Registration

Key Points

Public limited companies are broadly categorised into two distinct types:

- Employers: Must deduct PT from employees’ salaries

- Self-Employed Professionals: Must register and pay based on their income.

- Varies by state and income level, with different slabs for salaried employees and professionals.

- Employers register with the state tax authority and get a PT number.

- Self-employed professionals also register with the state’s tax department.

- Certain individuals (e.g., low-income earners, senior citizens) may be exempt.

- Non-compliance can lead to fines or legal issues.

Professional Tax Applicability

1. Salaried Employees: PT applies if the salary exceeds the state’s exemption limit. Employers deduct and remit the tax.

2. Self-Employed Professionals: Individuals like doctors, lawyers, and freelancers must pay PT based on their income.

3. Businesses/Employers: Required to deduct PT from employee salaries and remit it to the state.

4. State-Specific: Each state has different tax slabs and exemption criteria.

Exemptions: Low-income earners, senior citizens, and in some cases, women may be exempt.

FAQs for Professional Tax Registration

No, employees do not need to file PT returns. Employers are responsible for filing and remitting PT on behalf of their employees.

Yes, employers are required to deduct PT from an employee’s salary and remit it to the state government on the employee's behalf.

Yes, businesses must deduct PT from employees’ salaries and remit it to the state government.

Failure to register for PT may lead to fines, penalties, and potential revocation of registration for the business.

Yes, employers are required to deduct Professional Tax from employees' salaries and remit it to the state government.

If PT is not paid on time, a penalty of 1%–2% per month and interest may be charged, along with a fine for non-compliance.

Yes, if your business has less than 20 employees, PT can be paid quarterly, usually by the 15th of the next month after the quarter ends.

Yes, freelancers and self-employed professionals are required to pay PT based on their income, depending on the state.

No, PT is only applicable in certain states. States like Delhi, Uttar Pradesh, and Haryana do not have PT.

You can check your PT dues by visiting the respective state’s tax portal or by contacting the local tax office. Many states provide online services for checking dues.

Related Business Registrations

In addition to registration or incorporation, a business may require other registrations depending on the business activity undertaken. Talk to an Advisor to find out registrations your business may require post registration.