NGO Formation Registration

Register to become eligible to receive tax exempted grants, donations & funding from government & non-governmental organisations.

- Initial consultation to assess NGO registration requirements

- Assistance with drafting and preparation of necessary documents

- Guidance on choosing the appropriate legal structure for the NGO

- Support in obtaining necessary approvals and registrations from government authorities

- Regular updates on the registration process and timeline

- Assistance with any objections or queries from authorities

Book My

Table of Content

- Online NGO Registration in India

- Types of NGO Registration in India

- Objectives of NGO Registration

- FAQ

Online NGO Registration in India

Entrepreneurs who are planning for large-scale business operations can start a Public Limited Company registration in India. Unlike private companies, PLCs can raise funds from the general public by offering shares on stock exchanges. This allows them to access a wider pool of capital for growth.

BookMyCompliance can help you start your public limited company in India with ease and efficiency. Our comprehensive services cover everything from company registration to compliance management, ensuring a smooth and hassle-free setup process for your business.

These acts establish the legal framework, ensure compliance, and promote transparency. They foster trust, accountability, and governance in both nonprofit and business sectors in India. These create solid legal foundations for organizations focused on charitable, religious, educational, and other public welfare activities.

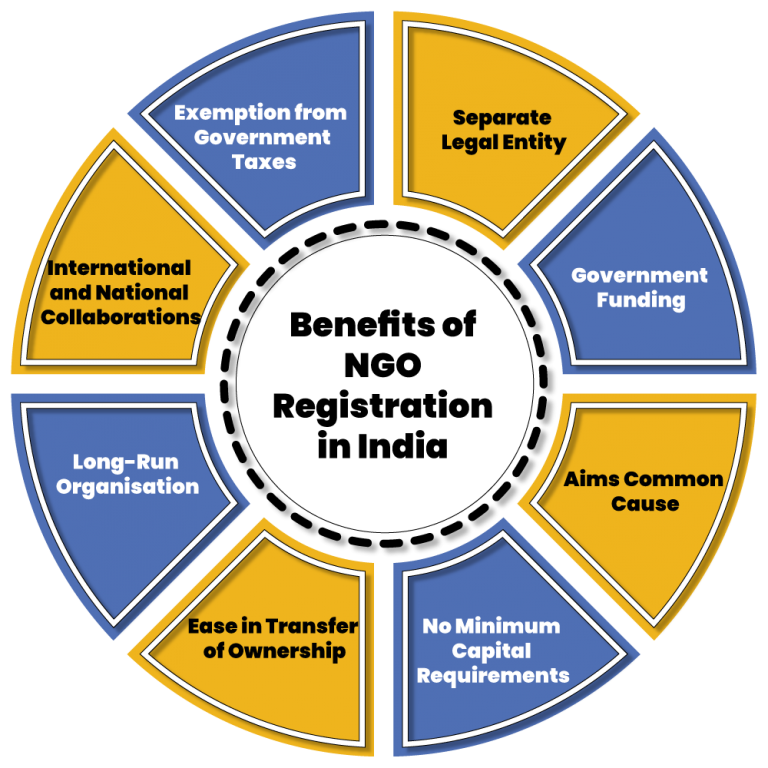

Benefits of NGO Registration

The benefits of the NGO Registration in India are as follows:

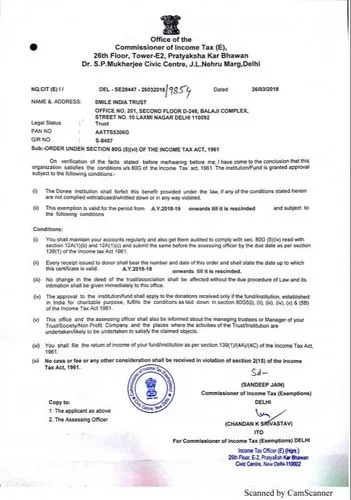

Exemption from Government Taxes

An NGO that is registered under the Societies Registration Act 1860 does not require to pay any Income Tax, as it works for the Welfare of the Society.

Separate Legal Entity

A registered NGO enjoys the status of a separate legal entity like any other public and private business firms.

Government Funding

Once an NGO gets registered under the Societies Registration Act 1860, it will get financial assistance from both the government and various private agencies.

FAQs on NGO Registration

NGO registration is the legal process of officially establishing a Non-Governmental Organization. It is necessary for credibility, transparency, and access to various benefits, including tax exemptions. Registered NGOs are better positioned to attract donors, collaborate with stakeholders, and carry out philanthropic activities effectively.

To register a Trust:

- Draft a Trust Deed adhering to the Indian Trusts Act, 1882.

- Appoint trustees and form a governing body.

- Submit registration documents to the Registrar of Trusts.

- Obtain tax exemptions under Section 12A and 80G.

In India, NGOs can be registered under three main structures:

- Trust

- Society

- Section 8 Company

Society registration involves:

- Drafting a Memorandum of Association (MoA) and By-laws in compliance with the Societies Registration Act, 1860.

- Forming a Governing Council.

Submitting registration documents to the Registrar of Societies. - Obtaining tax exemptions under Section 12A and 80G.

Related Business Registrations

In addition to registration or incorporation, a business may require other registrations depending on the business activity undertaken. Talk to an Advisor to find out registrations your business may require post registration.