MSME/UDYAM Registration

- Consultation on MSME Registration Process

- Verification and Submission of Application

- Temporary Reference Number after submission

- MSME / Udyam Registration Certificate and Registration Number

Book My

Table of Content

- MSME/Udyam Registration: An Overview

- Applicability for MSME/Udyam Registration

- Benefits of MSME/Udyam Registration

- Documents Required for MSME/Udyam Registration

- Step-by-Step Process for MSME/Udyam Registration

MSME/Udyam Registration: An Overview

FAQs for MSME/Udyam Registration

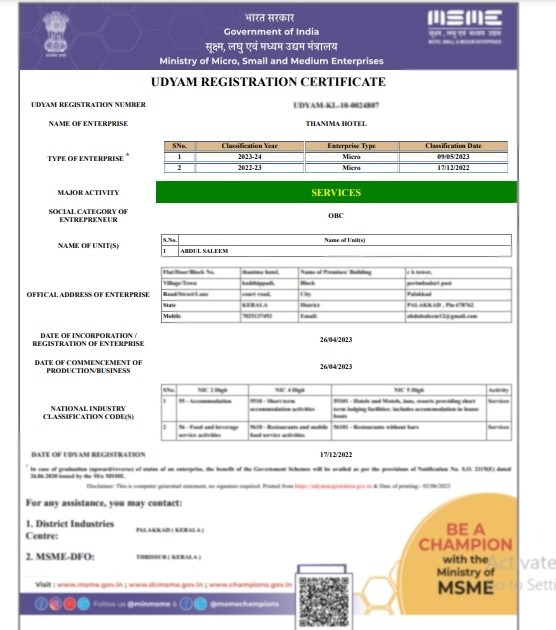

Udyam Registration is the process through which businesses are registered as Micro, Small, or Medium Enterprises (MSMEs). It provides access to various benefits offered by the government.

Sole proprietors, partnership firms, LLPs, private/public limited companies, and co-operatives involved in manufacturing or services can apply.

While not mandatory, it is highly beneficial for businesses seeking government schemes, financial support, and legal protections.

Businesses like reo Udyam Registration is the updated system replacing Udyog Aadhaar, and it has simplified the registration process while offering lifetime validity.tail shops, offices, restaurants, service providers (e.g., salons, consultancies), and wholesalers need registration.

Aadhaar number, PAN card (for businesses), bank account details, business address proof, and self-declaration of investment and turnover.

No, Udyam Registration is free of charge.

Yes, businesses already registered under Udyog Aadhaar need to migrate to Udyam Registration.

Udyam Registration is valid for a lifetime unless there are significant changes in the business classification.

The registration process is typically completed within a few hours after submitting the required details.

PAN is required for businesses like companies or partnerships but is optional for sole proprietors.

Non-registrationo Yes, businesses do not need to be GST-registered to apply for Udyam Registration, though having a GST number can be helpful. can lead to penalties, legal issues, or closure of your business.

Yes, Udyam Registration is for businesses incorporated in India.

Yes, individual entrepreneurs (sole proprietors) can apply using their Aadhaar number.

You can update your details by logging into the Udyam Registration portal and editing your information.

Yes, Udyam-registered businesses are eligible to participate in government tenders and procurement processes.

Benefits include access to government schemes, easier financing, protection against delayed payments, tax benefits, and participation in government tenders.

No, Udyam Registration is valid for a lifetime unless there are changes in investment or turnover.

Yes, startups that meet the criteria can also apply for Udyam Registration

Without Udyam Registration, businesses may miss out on government schemes, financing options, and legal protections.

You can check the status of your registration through the Udyam portal by entering your Udyam Registration Number.

Related Business Registrations

In addition to registration or incorporation, a business may require other registrations depending on the business activity undertaken. Talk to an Advisor to find out registrations your business may require post registration.