Income Tax Audit

- Ensures Accuracy

- Prevents Tax Evasion

- Enhances Credibility

- Facilitates Loan Approvals

- Improves Compliance

Book My

Table of Content

- Income Tax Audit

- Eligibility for Tax Audit

- Benefits of Tax Audit

- Types of Tax Audit

- Documents Required for Tax Audit

Income Tax Audit

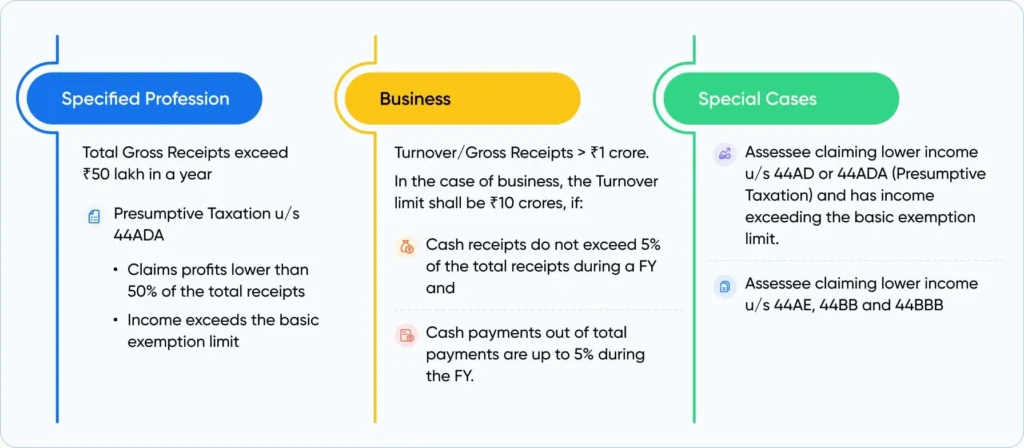

Eligibility for Tax Audit

- If the total sales, turnover, or gross receipts exceed ₹1 crore in a financial year.

- However, if the business opts for presumptive taxation under Section 44AD, and declares income less than 8% (or 6% for digital receipts) of the turnover and total income exceeds the basic exemption limit, tax audit is mandatory even if turnover is below ₹2 crore.

- If the gross receipts from the profession exceed ₹50 lakhs in a financial year.

- Under Section 44AD (business), 44ADA (profession), or 44AE (transportation business): If the taxpayer claims income lower than the presumptive rate and their total income exceeds the basic exemption limit, a tax audit is required.

Benefits of Tax Audit

S.No. | Benefit | Description |

1 | Ensures Accuracy | Verifies correctness of financial statements and tax returns. |

2 | Prevents Tax Evasion | Discourages deliberate underreporting or misreporting of income. |

3 | Enhances Credibility | Boosts the credibility of financial information for stakeholders and investors. |

4 | Facilitates Loan Approvals | Audited accounts are often preferred by banks and financial institutions. |

5 | Improves Compliance | Encourages adherence to tax laws and regulations. |

6 | Reduces Scrutiny Risk | Lowers the chances of future detailed scrutiny or investigation by tax officers. |

7 | Identifies Financial Irregularities | Helps detect and correct errors or fraud in accounting records. |

8 | Supports Business Decision-Making | Provides reliable data for strategic planning and financial decisions. |

9 | Assists in Tax Planning | Helps in optimizing tax liability through proper guidance and insights. |

10 | Legal Compliance Proof | Serves as a documented proof of compliance with tax laws. |

Types of Tax Audit

1. Statutory Audit

- Conducted under the Companies Act, 2013.

- Applicable to companies.

- Performed by a Chartered Accountant.

- Ensures that the financial statements are true and fair.

2. Tax Audit (Under Section 44AB)

- Conducted specifically for tax purposes.

- Required when turnover/gross receipts exceed specified limits.

- Ensures the correctness of income declared and deductions claimed.

3. Internal Audit

- Conducted by internal staff or an appointed auditor.

- Focuses on improving internal processes, controls, and risk management.

- Not mandatory under tax law but can support tax audit readiness.

4. Cost Audit

- Mandated under the Cost Accounting Records Rules.

- Relevant to certain industries like manufacturing or utilities.

- Ensures cost records are accurate and comply with standards.

5. Transfer Pricing Audit

- Applicable to entities involved in international or specified domestic transactions.

- Ensures that pricing between related parties is at arm’s length.

- Requires filing of Form 3CEB certified by a Chartered Accountant.

6. GST Audit (Note: Suspended in many cases after amendments)

- Was applicable to businesses with turnover above the specified threshold under GST law.

- Reviewed compliance with GST laws, input tax credit, and output tax.

FAQs for Tax Audit

A Tax Audit is an examination of your financial records to ensure compliance with the provisions of the Income Tax Act, especially regarding income, deductions, and expenses claimed.

Individuals, firms, or companies whose turnover or gross receipts exceed the prescribed limit (usually ₹1 crore for business and ₹50 lakhs for profession) are required to undergo a Tax Audit under Section 44AB.

The due date is 30th September of the Assessment Year, unless extended by the Income Tax Department.

• Form 3CA/3CB – Audit Report

• Form 3CD – Detailed Statement of Particulars

The penalty is 0.5% of turnover or gross receipts, subject to a maximum of ₹1,50,000.

- Form 3CA: Used when the assesse is already subject to a statutory audit under another law (e.g., Companies Act).

- Form 3CB: Used when there is no statutory audit requirement; applicable mainly to proprietorships or small partnerships.

Yes, if the assessee proves there was a reasonable cause for the failure (e.g., natural disaster, illness, technical issues, etc.).

Yes. A Statutory Audit is done under the Companies Act, while a Tax Audit is done for income tax compliance under Section 44AB.

Yes, if such a business declares lower income than prescribed and its total income exceeds the exemption limit, a tax audit is mandatory.

Only a Chartered Accountant (CA), holding a valid certificate of practice, is authorized to conduct a Tax Audit.

Yes, it can be revised before the due date of filing the return, provided errors or omissions are discovered.

Form 3CD is a detailed annexure that accompanies Form 3CA/3CB and contains particulars about business transactions, deductions, compliance, TDS, etc.