Online Limited Liability Partnership Registration (LLP)

- DPIN and DSC

- Fees & Stamp duty

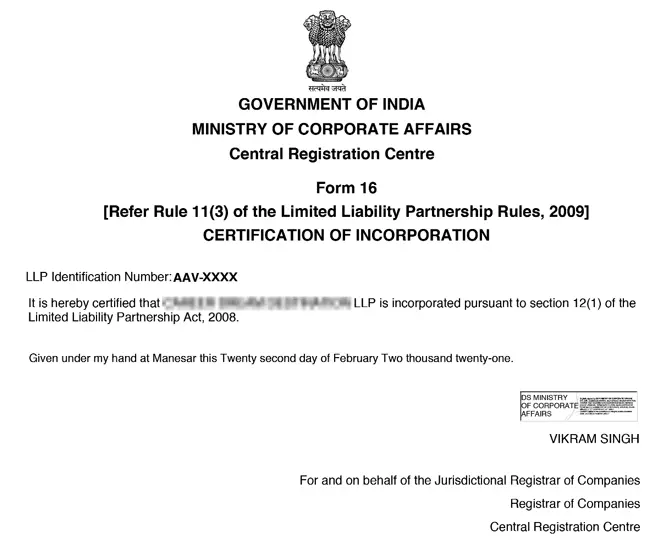

- LLP Incorporation Certificate

- LLP PAN and TAN

- Draft of LLP agreement

Get Quote Instantly

Right Plan for your business

Standard

Financa dummy text of the printing and typesetting industry.

- Finance Consulting

- Business Economiext printing

- industr um has been

- Investment typesetting

Starter Plan

Financa dummy text of the printing and typesetting industry.

- Finance Consulting

- Business Economiext printing

- industr um has been

- Investment typesetting

Starter Plan

Financa dummy text of the printing and typesetting industry.

- Finance Consulting

- Business Economiext printing

- industr um has been

- Investment typesetting

Table of Content

- Limited Liability Partnership (LLP) Registration - Overview

- Main Features of Limited Liability Partnership (LLP)

- LLP Incorporation Process

- Documents Required for LLP Registration in India

- Taxation of LLP & Its Partners

- Key Income Tax & ROC Filing Compliances for LLPs

Limited Liability Registration (LLP) Registration in India

Public Limited Company Registration - Overview

Main Features of Limited Liability Partnership (LLP)

Limited Liability

Limited Liability Partners have limited liability to the extent of their capital contribution, protecting personal assets from business debts.

Separate Legal Entity

Separate Legal Entity LLP is a separate legal entity, distinct from its partners, capable of owning property and entering contracts.

Flexibility in Management

Flexibility in Management LLP allows flexible management and operations, unlike a traditional company, with decisions made by partners.

No Minimum Capital Requirement

No Minimum Capital Requirement There is no minimum capital requirement to form an LLP, offering a low entry barrier.

Perpetual Succession

Perpetual Succession LLP continues to exist even if partners change, ensuring business continuity.

Taxation

Taxation LLPs are taxed as separate entities, and income is taxed at a lower rate compared to other business structures.

No Requirement for Annual AGM

No Requirement for Annual AGM Unlike companies, LLPs are not required to hold Annual General Meetings (AGMs), reducing formalities.

Fewer Compliance Requirements

Fewer Compliance Requirements LLPs face less stringent compliance regulations and minimal reporting compared to corporations.

Ownership & Partnership Flexibility

Ownership & Partnership Flexibility Partners can transfer ownership by altering the partnership agreement, with no restrictions on shareholding.

No Audit Requirement (Below Limit)

No Audit Requirement (Below Limit) LLPs with an annual turnover of less than ₹40 lakhs or capital below ₹25 lakhs are exempt from mandatory audits.

LLP Incorporation Process

• Check Name Availability: Ensure the name is unique and doesn’t conflict with existing trademarks or company names. You can check name availability on the MCA portal.

• Naming Guidelines: The name must end with “LLP” or “Limited Liability Partnership.”

• Reserve Name: If needed, file Form 1 for name approval via the MCA portal.

• Required for Filing: A valid DSC is needed for all partners (designated partners) to sign forms and documents electronically.

• Process: Obtain a DSC from a government-recognized certifying authority.

• Mandatory for Designated Partners: At least two designated partners need to have a valid DIN. If they don’t have one, they must apply using Form DIR-3.

• Verification: Verify the identification and documents of each designated partner (e.g., passport, Aadhaar).

• Key Components: The agreement should outline:

o Profit-sharing ratio

o Roles and responsibilities of partners

o Contribution of each partner

o Management structure

o Termination, resignation, or transfer of ownership

• Notarization: Once the agreement is drafted, it must be signed and notarized by all partners.

• Form FiLLiP (Filing of Incorporation for LLP): This form needs to be filed online through the MCA portal. Attach the following documents:

o Proof of Address: Utility bills, rental agreement, or any valid document showing the office address.

o PAN Card of Partners: A copy of the PAN cards for all designated partners.

o ID Proof: Valid identity proof for each partner (Aadhaar, passport, voter ID, etc.).

o Photographs: Passport-sized photographs of all partners.

o DSC of Partners: Attach the DSC for electronic submission.

• Once the forms and documents are successfully submitted and verified, the MCA will issue the Certificate of Incorporation.

• The LLP is now a legal entity and can begin operations officially.

• PAN (Permanent Account Number): Apply for the LLP’s PAN card, which is essential for tax purposes.

• TAN (Tax Deduction and Collection Account Number): If the LLP plans to deduct taxes at source (TDS), it must apply for a TAN.

• Process: Apply for GST registration on the GST portal after receiving the PAN.

• After receiving the Certificate of Incorporation, PAN, and TAN, open a business bank account in the name of the LLP. The bank will require:

o Certificate of Incorporation

o LLP Agreement

o PAN of the LLP

o Proof of address for the registered office

o Identity proof of the partners

• MSME Registration: If the LLP qualifies as a Micro, Small, or Medium Enterprise, it can benefit from government schemes and subsidies.

• FSSAI Registration: If the LLP deals in food products, it will require FSSAI registration.

• Import Export Code (IEC): For businesses engaged in international trade.

• Industry-Specific Licenses: Depending on the nature of the business, additional licenses may be needed (e.g., trade licenses, pollution control permits, labour law registrations).

• Statutory Filings: LLPs are required to file an Annual Return (Form 11) and Statement of Accounts and Solvency (Form 8) every year with the MCA.

• Accounting Records: Maintain proper accounting records, even if the LLP is not required to undergo an audit (for LLPs with turnover below the prescribed limit).

Tax Filing: File income tax returns on time and maintain compliance with GST regulations.

Related Business Registrations

Private Limited Company Registration

Public Limited Company Registration

One Person Company Registration

GST

Registration

Producer Company Registration