Producer Company Registration

Looking to get your private limited company registered? You are in the right spot!

- Affordable & Clear Pricing : Company registration starting at just ₹999 + Govt fees—no surprises, no hidden costs.

- End-to-End Compliance : Support We take care of everything: SPICe+ (INC-32), eMoA (INC-33), eAOA (INC-34), DSC, PAN, and TAN—so you don’t have to worry.

- Bonus Services After Registration : Get free MSME registration, assistance with GST filings, and help with setting up your business bank account.

Get Quote Instantly

Right Plan for your business

Starter Plan

Financa dummy text of the printing and typesetting industry.

$39.00Per Month

- Finance Consulting

- Business Economiext printing

- industr um has been

- Investment typesetting

Starter Plan

Financa dummy text of the printing and typesetting industry.

$39.00Per Month

- Finance Consulting

- Business Economiext printing

- industr um has been

- Investment typesetting

Starter Plan

Financa dummy text of the printing and typesetting industry.

$39.00Per Month

- Finance Consulting

- Business Economiext printing

- industr um has been

- Investment typesetting

Private Limited Company Registration - Process , Fees and Documents

Starting a private limited company in India is a preferred option for entrepreneurs aiming to establish professional and recognised businesses. Governed by the Companies Act, 2013, and regulated by the Ministry of Corporate Affairs (MCA), this business structure offers benefits like limited liability, enhanced credibility, and growth opportunities.

A private limited company (commonly abbreviated as Pvt Ltd) is considered a separate legal entity from its owners, offering a secure framework for operations while safeguarding the personal assets of its members. This business structure, governed by the Companies Act, 2013, is popular among entrepreneurs and small to medium-sized businesses (SMEs) for its combination of limited liability protection, ownership control, and scalability.

For instance, startups like Swiggy began as private limited companies due to their ability to secure venture capital funding while maintaining limited liability for founders.

Table of Content

- Private Limited Company Registration - Overview

- What is Private Limited Company?

- What Are the Key Features and Benefits of a Private Limited Company?

Private Limited Company Registration - Overview

Starting a private limited company in India is a preferred option for entrepreneurs aiming to establish professional and recognised businesses. Governed by the Companies Act, 2013, and regulated by the Ministry of Corporate Affairs (MCA), this business structure offers benefits like limited liability, enhanced credibility, and growth opportunities.

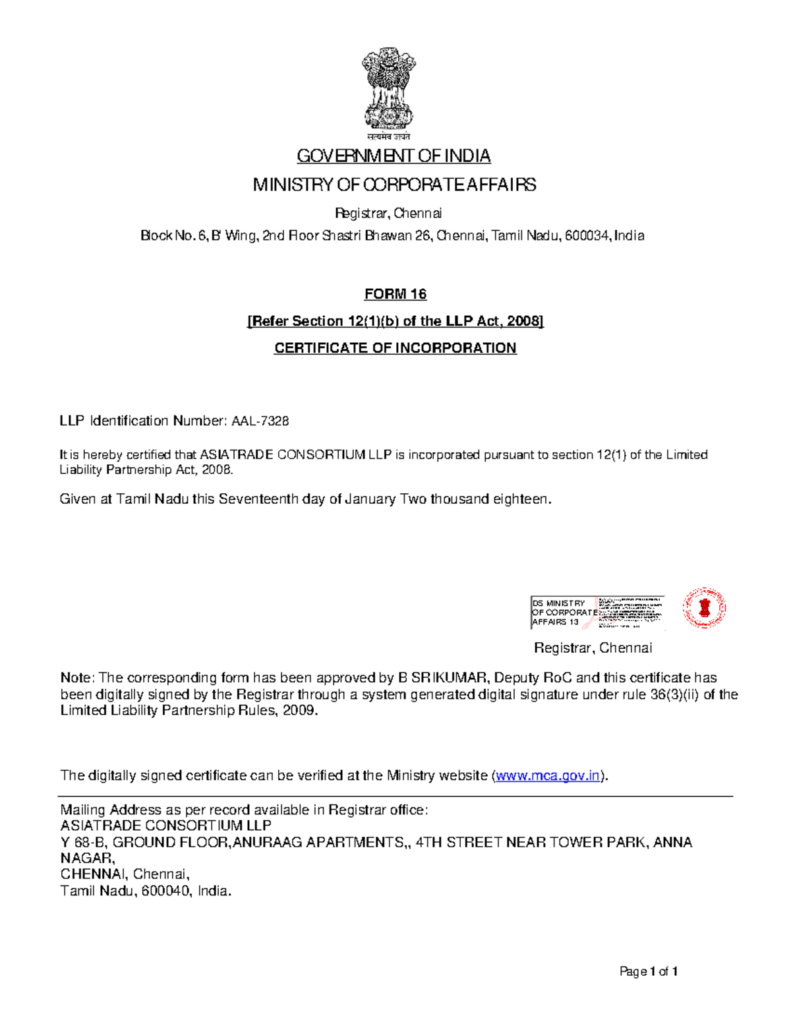

The process involves submitting the SPICe+ form, obtaining Digital Signature Certificates (DSC) for directors, and securing Director Identification Numbers (DIN). Once approved by the Registrar of Companies (RoC), your business receives a Certificate of Incorporation, making it a separate legal entity. This allows the company to own assets, sign contracts, and operate independently.

What is Private Limited Company?

In India, a Private Limited Company is a type of business structure governed by the Companies Act, 2013. It is one of the most common forms of business entities, particularly for small to medium-sized businesses. The key features of a Private Limited Company in India are:

1. Limited Liability

The shareholders of a Private Limited Company have limited liability, meaning their personal assets are protected. If the company faces financial difficulties or debts, the liability of the shareholders is limited to the amount they have invested in the company.

2. Minimum and Maximum Shareholders

A Private Limited Company in India must have at least 2 shareholders and can have a maximum of 200 shareholders. This is different from a public company, which can have unlimited shareholders.

3. Separate Legal Entity

A Private Limited Company is a separate legal entity from its owners. It can enter into contracts, sue or be sued in its own name, and own property independently of its shareholders.

4. Transfer of Shares

The shares of a Private Limited Company are not freely transferable to the public. There are restrictions on the transfer of shares, which means that shareholders can only transfer shares to other individuals or entities with the approval of other shareholders, as per the company’s Articles of Association.

5. Management and Ownership

The management and control of the company are vested in the directors, who are appointed by the shareholders. Shareholders generally do not take part in the daily management of the company but have the right to vote on important matters at annual general meetings (AGMs).

6. Registration and Compliance

- A Private Limited Company must be registered with the Registrar of Companies (RoC) in India. It is required to comply with the provisions of the Companies Act, 2013, including regular filing of financial statements, annual returns, and conducting AGMs.

- The company must also maintain statutory records, such as minutes of meetings and registers of directors and shareholders.

7. Taxation

Private Limited Companies in India are subject to corporate tax rates and must file tax returns annually. The tax rate depends on the company’s turnover and other factors.

8. Minimum and Maximum Directors

A Private Limited Company in India must have a minimum of 2 directors and a maximum of 15 directors. One of the directors must be a resident of India.

What Are the Key Features and Benefits of a Private Limited Company?

1. Improves Credibility

Private Company improves credibility by being registered as a corporate entity.

2. Attract Funding

Syndicate both equity and debt funds to have an optimal capital structure.

3. Foreign Investment

Business may attract foreign direct investment (FDI) under the automatic route.

4. Separate legal Entity

A Private Limited Company is a legal entity in its own right, allowing the business owner to keep their assets separate from the business itself. This means that the business owners aren’t subject to any personal liability.

Advantages and Disadvantages of a Private Limited Company

| Aspect | Advantages | Disadvantages |

|---|---|---|

| Limited Liability | Protects personal assets. Only liable for the amount invested. | Personal guarantees may still be required for loans, risking personal assets. |

| Separate Legal Entity | Operates independently from owners. Can own property and sign contracts. | Requires filing legal documents (MOA, AOA) to maintain status |

| Perpetual Succession | Continues even if owners or directors change. | Share transfers need approval, delaying transitions. |

| Ease of Fundraising | Attracts investors easily | Fundraising limited to a maximum of 200 shareholders. |

| Trust and Credibility | Builds trust with clients and vendors due to formal structure. | Financial disclosures expose sensitive information to competitors. |

| Tax Benefits | Eligible for tax exemptions (e.g., Startup India). | Must file taxes and comply with corporate tax deadlines. |

| Ownership Flexibility | Easy transfer of shares with approval. | Share transfers require approval, delaying decisions |

| Structured Governance | Clear roles and responsibilities reduce conflicts. | Decision-making can be slower due to the need for consensus. |

| Business Continuity | Business continues regardless of ownership changes | Dissolution is a complex and expensive process. |

| Compliance Requirements | Regular audits and filings improve transparency and trust. | Non-compliance leads to penalties and reputational damage |

| Setup Costs | Setup cost justified by long-term growth. | Higher registration and compliance costs compared to simpler business structures. |

Related Business Registrations

In addition to registration or incorporation, a business may require other registrations depending on the business activity undertaken. Talk to an Advisor to find out registrations your business may require post registration.

Private Limited Company Registration

Public Limited Company Registration

One Person Company Registration

GST

Registration

Producer Company Registration